Tax rates to rise for higher earners in Scotland

This video can not be played

To play this video you need to enable JavaScript in your browser.

Income tax rates for higher earners are expected to be increased in Scotland for the next financial year.

The BBC understands the deputy first minister, John Swinney, will announce the changes in his budget statement.

He is expected to put up the higher rate of tax from 41p to 42p in the pound and to increase the top rate from 46p to 47p.

The tax threshold for the top rate is also expected to be lowered from £150,000 to closer to £125,000.

This change has already been announced for other parts of the UK by Chancellor Jeremy Hunt.

Mr Swinney had been due to deliver his budget statement at about 14:30 – but Presiding Officer Alison Johnstone suspended the session for 30 minutes before he started speaking so she could investigate how details of the tax rises were reported by the BBC in advance of the statement.

- Live coverage of the Scottish Budget

- Which taxes can the Scottish government change?

- What to look out for in the Scottish Budget

The BBC also understands that there could be about £500m extra for local government in the budget. Councils had been campaigning for a lot more.

There will also be an increase in the second homes tax part of the Land and Buildings Transaction Tax – the Scottish equivalent of stamp duty – from 4% to 6%.

However there is not expected to be a new public sector pay policy announcement, with the Scottish government apparently wanting to continue discussions with unions.

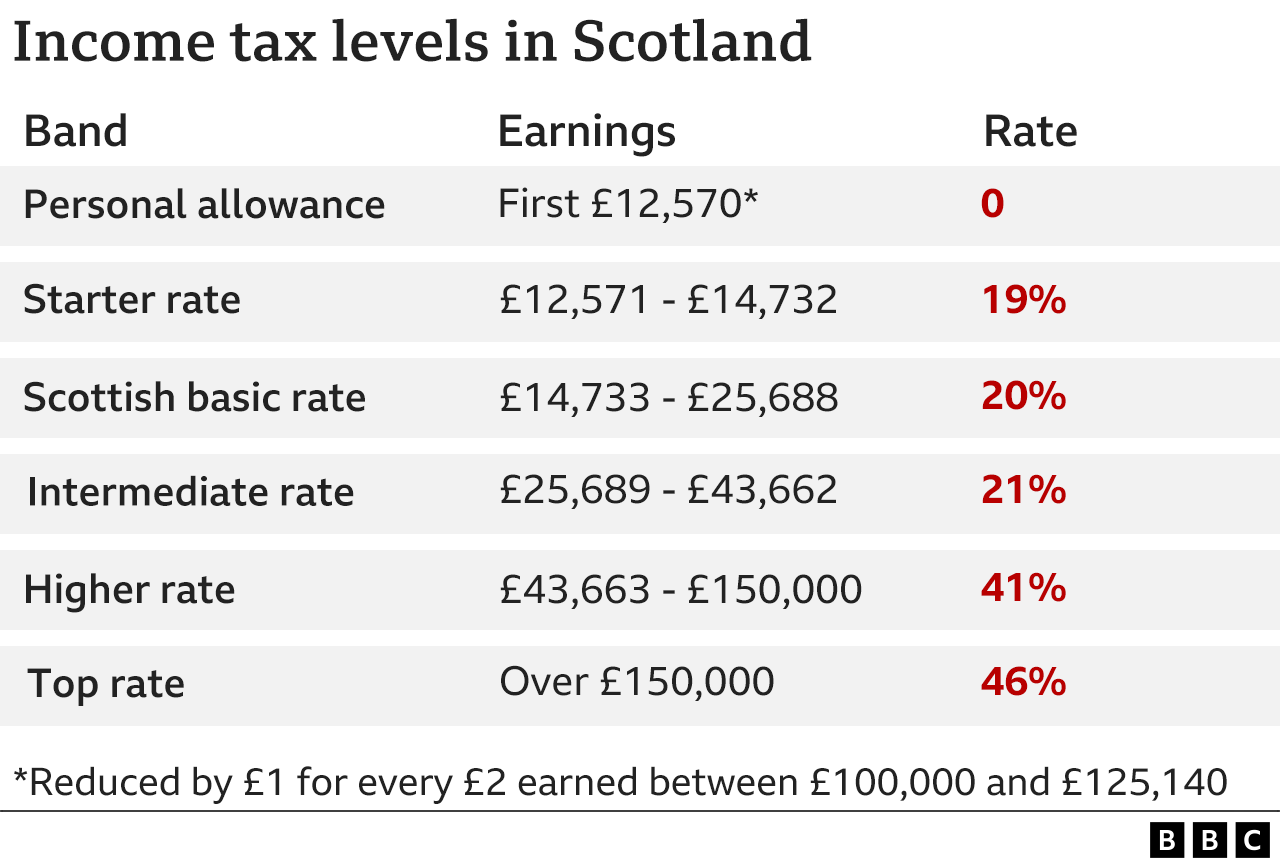

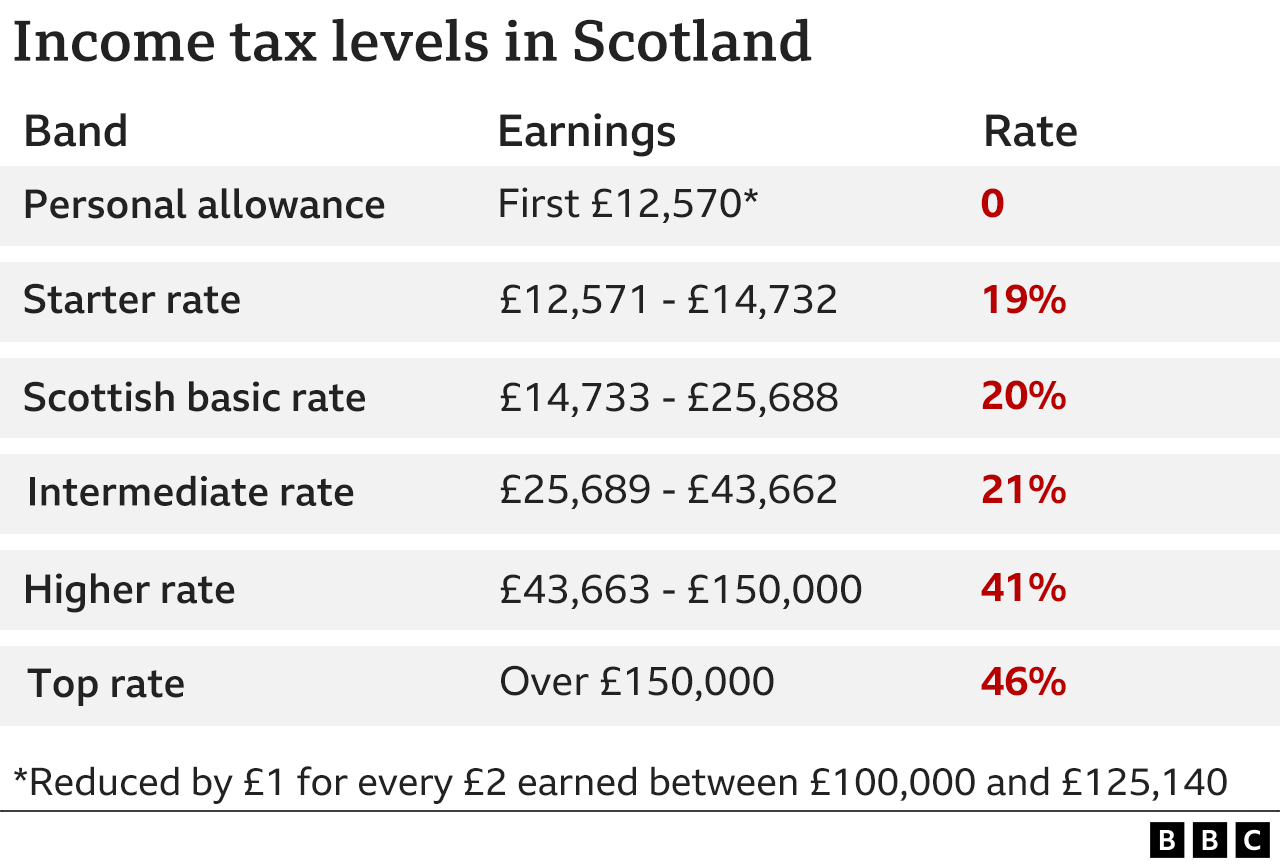

Income tax rates in Scotland, as well as several other taxes, are set by the Scottish government rather than at Westminster.

Scotland has a total of about 2.5 million tax payers, of whom about 362,000 are in the higher rate bracket while a further 14,700 pay the top rate of income tax, according to economists at the Fraser of Allander Institute.

The threshold for the 41p higher rate has been frozen in recent years at £43,663 in Scotland – lower than the £50,271 elsewhere in the UK.

The changes mean that everyone earning more than that threshold will pay more income tax than they did last year, and more than people earning the same salary elsewhere in the UK.

However it is not thought likely that the rate paid by lower earners will rise, with First Minister Nicola Sturgeon previously saying this would be counterproductive in a cost of living crisis.

The changes are designed to increase the revenue the Scottish government generates so it can spend more on key public services.

They will be a significant departure from the SNP’s manifesto aim not to alter income tax rates for the duration of this parliament and will also widen the divergence in tax policy between Scotland and the rest of the UK.

Mr Swinney, who is standing in as the country’s finance secretary while Kate Forbes is on maternity leave, is due to begin his budget statement in the Scottish Parliament at about 14:25.

Speaking ahead of the statement, First Minister Nicola Sturgeon said the government needed to take action to “protect public services, protect the most vulnerable and protect the transition to net zero which is so important to the economy as well as the environment.”

Mr Swinney said the government would use its taxation powers to the “maximum extent that is responsible” and warned that “difficult decisions” will need to be made on funding for public services.

He said his plans will help create a “fairer, more equal Scotland” and will help address inequality, create wealth and opportunity and make sure public services remain sustainable.

However, he has also warned that the country was still facing “sustained economic pressure” on public finances.

Many departments are expected to be see real-terms cuts as the government continues to grapple with high inflation and interest rates and the cost of economic support measures.

- The latest headlines from Scotland

- Read more stories on Scottish politics

The Scottish government is also committed to controversial plans for setting up a new National Care Service, which is estimated to cost between £664m to £1.26bn over the next five years.

And ministers will face questions about £20m which had been earmarked to deliver an independence referendum in the next financial year despite the Supreme Court recently ruling that it does not have the power to hold one.

Unions and anti-poverty campaigners had been demanding tax increases for higher earners, while the Conservatives and some business voices have warned that tax rises could be a drag on economic recovery.

Scottish Conservative finance spokeswoman Liz Smith told BBC Scotland that she expected to see tax rises given the “very difficult fiscal circumstances”.

But she added: “What I’m much more worried about is the differential between Scotland and the rest of the UK.

“It is absolutely essential that Scotland is an attractive place to work and live and invest, and if we see a widening of those differentials that affects that attractiveness.”

Published at Thu, 15 Dec 2022 15:03:15 +0000