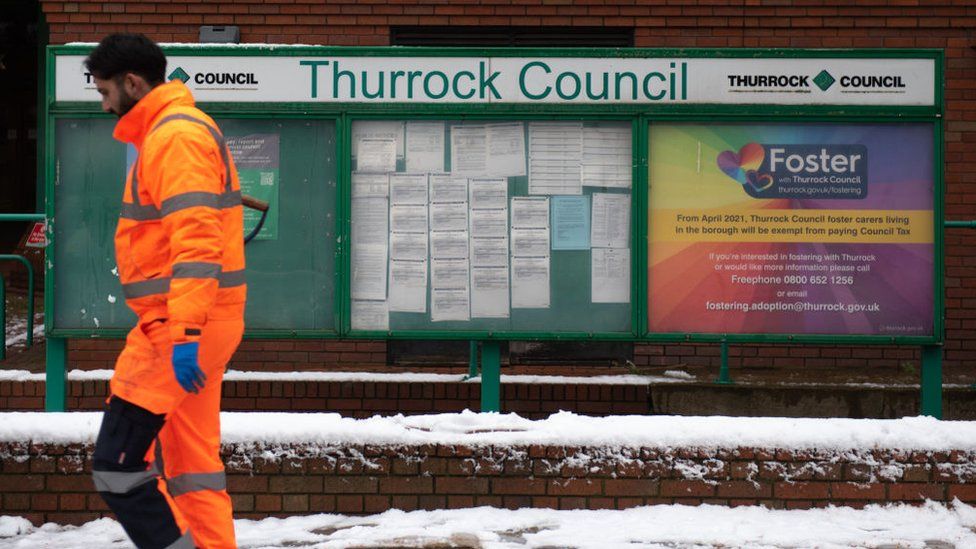

Bankrupt Thurrock Council asks for £636m bailout and tax hike

A council that is effectively bankrupt is in talks with government to borrow up to £636m to help balance its books.

Thurrock Council in Essex has a £1.5bn debt following a series of high-risk investments.

The Conservative-run unitary local authority is also due to find out whether Westminster will allow it to increase council tax by more than 5%.

The Labour opposition leader said the government loan would only serve as a “sticking plaster”.

Thurrock has asked for an initial £182.5m from the Treasury to prop up its budget for 2023-24.

The loaned funds would end up accounting for 57% of its spending.

The council however hoped to recoup at least £475m from the solar farms it started purchasing in 2018.

Last year, the Conservative government’s Chancellor of the Exchequer, Jeremy Hunt, said councils could only increase their share of tax on residents by 4.99%, but an exception was expected to be made for Thurrock.

The council’s cabinet member for finance, Graham Snell, said: “There’s no point beating around the bush with that; we would be prepared to go above the 5% should the government allow us to do that.”

Thurrock has the largest funding deficit of any local authority in England.

The £636m bailout figure being discussed with government was revealed at an overview and scrutiny committee meeting at Thurrock on Thursday.

Labour opposition leader John Kent said: “This is only forestalling the day when you actually have to do something decisive to solve this problem.

“These sticking plasters just won’t do.”

Mr Kent said he was worried the council would sell its assets, such as scout halls and community halls, and he asked that they be transferred to community ownership.

A decision is yet to be made over the ownership of the Thameside complex in Grays, which includes a 300-seat theatre, museum, community space and library.

Find BBC News: East of England on Facebook, Instagram and Twitter. If you have a story suggestion email eastofenglandnews@bbc.co.uk

-

Bankrupt council has systemic weaknesses – leader

-

26 January

-

-

Council with £1.5bn debt could lose more powers

-

25 January

-

-

Finance chief at debt-ridden council resigns

-

20 January

-

-

Debt-ridden council to pay £50k to resigning CEO

-

20 December 2022

-

-

Council with £469m budget gap ‘took risks’

-

30 November 2022

-

-

Tory council leader resigns as government steps in

-

2 September 2022

-

Related Internet Links

-

Thurrock Council

Published at Fri, 03 Feb 2023 13:16:53 +0000