Bank cuts interest rates and slashes growth forecast

This video can not be played

To play this video you need to enable JavaScript in your browser.

-

-

3131 Comments

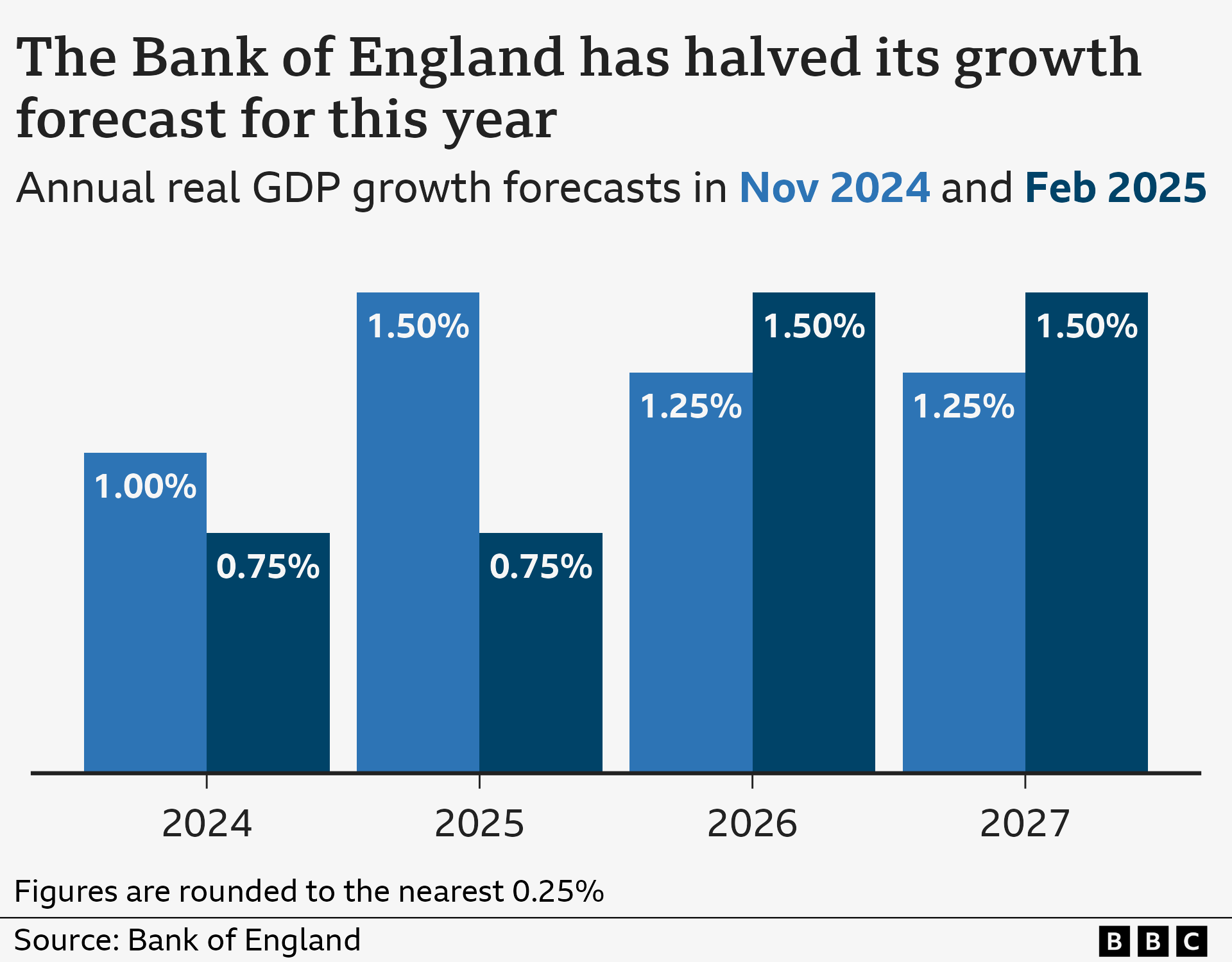

The Bank of England has halved its growth forecast for this year as it cut interest rates to the lowest level for more than 18 months.

The economy is now expected to grow by 0.75% in 2025, the Bank said, down from its previous estimate of 1.5%.

The government has made growing the economy one of its key aims. Prime Minister Sir Keir Starmer told the BBC he was “not satisfied with growth” and the downgraded forecast “just spurs us on”.

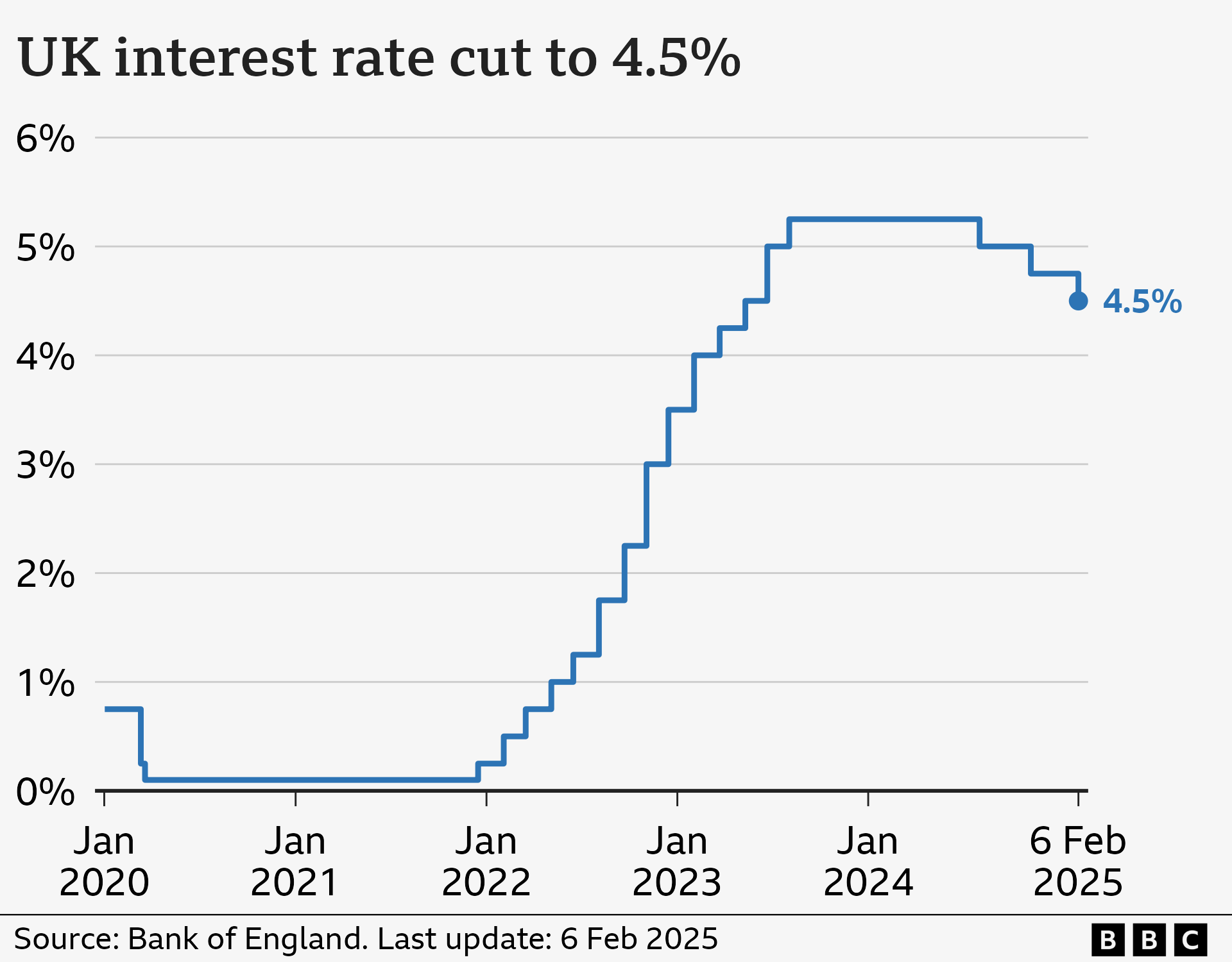

The new forecast came as the Bank cut interest rates to 4.5% from 4.75%. Its governor, Andrew Bailey, said that rates remain on a downward path.

-

When will interest rates fall?

-

2 hours ago

-

-

Low growth and rising prices – it’s looking gloomy for the UK

-

5 hours ago

-

Mr Bailey said the Bank expected to be able to cut rates further “but we will have to judge meeting by meeting, how far and how fast”.

“We live in an uncertain world, and the road ahead will have bumps on it,” he added.

Speaking to the BBC, Mr Bailey stressed that the Bank needs to remain “gradual and careful” when continuing to cut rates because “there is a lot more uncertainty” and because of the predicted rise in inflation.

While it cut its growth forecast for this year, the Bank upgraded its predictions for both 2026 and 2027. The economy is now expected to grow by 1.5% in both of those years, the Bank said, up from 1.25%.

However, it also predicted that higher energy and water bills would push up inflation “quite sharply” later this year, and warned there were a number of factors that could affect inflation including possible trade tariffs in the US.

Inflation – the rate at which prices rise – is now expected to rise to 3.7% and take until the end of 2027 to fall back to its 2% target.

Last week, Chancellor Rachel Reeves announced a number of measures to try to boost the UK economy.

However, her decision in last year’s Budget to increase employers’ National Insurance contributions from April has led to a wave of criticism from businesses, who argue it will push up prices and hit investment and jobs.

Mr Bailey said the impact of the Budget, particularly the looming higher costs of employing people, was feeding through into lower confidence for businesses and households.

“There’s no question that the increase in the cost of employment does have an effect,” he told the BBC.

“We’re very focused on how that increased cost of employment is going to pass through.”

Sir Keir told the BBC the government would turn the economy around with a focus on “build baby build” and by making “tough decisions whether on planning, on infrastructure, on nuclear”.

Shadow chancellor Mel Stride said while the rate cut would be good news for many families and businesses, the government’s “disastrous Budget” was likely to mean fewer rate cuts this year than expected.

Paul Johnson, director of the Institute for Fiscal Studies think tank, said it was “very worrying” for the government that the Bank of England has “really, quite significantly” downgraded its forecasts for economic growth.

He added that if the official government forecaster – the Office for Budget Responsibility – changes its forecast in line with the Bank’s then “the chancellor is in big trouble” when it comes to meeting her self imposed debt rules.

“That means… the tax revenues the chancellor is relying on are unlikely to come in as expected, and even tougher choices on spending and tax going forward.”

Mortgage impact

The interest rate cut means that for the 629,000 homeowners on mortgage tracker deals that move in line with the base rate, there will typically be a £29 fall in monthly repayments.

The near 700,000 people on standard variable rate mortgages will have to wait to see if their lender responds.

Those on a fixed mortgage deal will see no immediate change, but there might be cheaper deals available for new and renewing customers.

However, the rate cut is likely to lead to lower returns for savers.

Nicola Price and her husband John have still got 18 months remaining on their current mortgage deal, and welcome lower interest rates as it means they will pay less interest on their next mortgage – if rates remain low.

Nicola wishes for “certainly no more increases” and thinks the sweet spot for her would be a rate of around 3%.

However, the couple also see that falling interest rates aren’t good news for everyone as their parents “rely heavily” on a better interest rate on their savings.

In its quarterly inflation report, the Bank said economic growth had been “broadly flat since March last year”.

The UK economy showed zero growth between July and September.

For the following three months, the Bank of England now expects it to shrink by 0.1% against a previous forecast of 0.3% growth.

A recession is defined as two consecutive three-month periods of economic contraction.

The Bank now expects the economy to grow by just 0.1% between January and March, down from the 0.3% it had predicted in November.

Get in touch

How will your finances be affected by a rates cut?

-

UK economy disappoints despite return to growth

-

16 January

-

-

Why are prices rising in the UK?

-

15 January

-

Sign up for our Politics Essential newsletter to read top political analysis, gain insight from across the UK and stay up to speed with the big moments. It’ll be delivered straight to your inbox every weekday.

Related topics

- Inflation

- Cost of Living

- UK economy

- Bank of England

Published at Thu, 06 Feb 2025 17:13:19 +0000